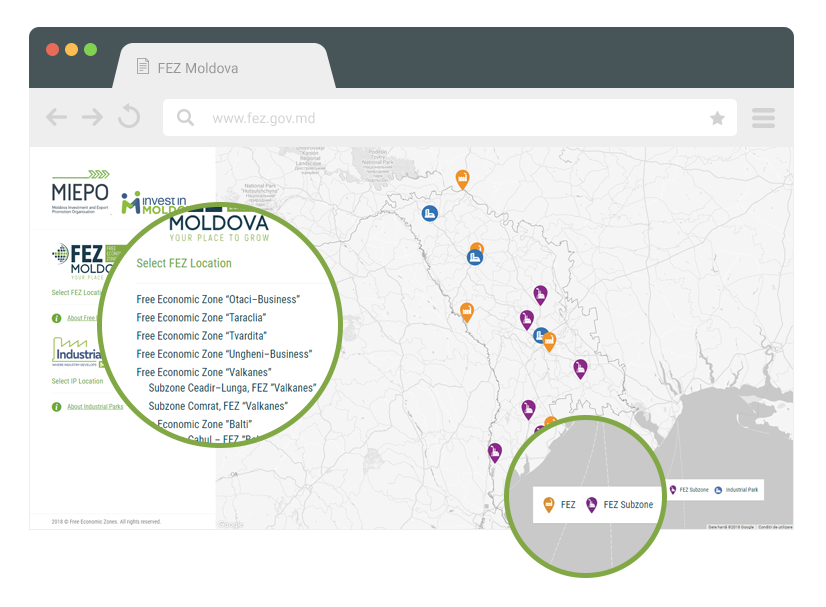

Another reason to invest in Moldova is the presence of the Free Economic Zones. These are a class of special economic zone (SEZ) designated by the trade and commerce administrations of various countries. In Moldova, there are 7 free economic zones.

In 1995 , Moldova introduced free economic zone (FEZ) legislation with the aim of accelerating socioeconomic development by attracting domestic and foreign investment, promoting exports, and creating employment. Since then, seven free economic zones offering tax and customs benefits have been established.

The free economic zones have been successful in attracting investment from both domestic

and foreign sources. Since 2002, the volume of foreign and domestic investments in the zones increased five-fold, reaching US$212 million in 2014. While not all investments in the zones have foreign origin, investments in the zones amount to 80 percent of total FDI stock in Moldova for the period 2009-2014.

Any physical or legal entity, either from inside or outside Moldova can become a resident of the Free Economic zone. The tax facilities are as follows:

1. An exemption of 50% on the tax imposed on sales made from exports from inside the Free Economic Zone

2. An exemption of 25% on the tax imposed on sales made from activities other than exports (services)

3. An exemption for a total of 3 years on any tax imposed on sales made from exports, as a consequence of investing at least 1 million USD

4. An exemption for a total of 5 years on any tax imposed on sales made from exports, as a consequence of investing at least 5 million USD

5. There is no VAT applied on services delivered inside the Free Trade Zone

6. 0% VAT applied on good and services delivered ro the Free Trade Zone, from outside the Republic of Moldova, good and services delivered to the Free Trade Zone, from the rest of the Republic of Moldova, good and services delivered from one resident of the Free Trade Zone to another.

7. Exemption from excise tax for goods delivered to the Free Trade Zone from outside the Republic of Moldova, from other Free Trade Zones, the rest of Moldovan territory, as well as the goods originating from this zone and exported outside the territory of Moldova.

8. Exemption from excise tax for goods delivered inside the Free Trade Zone and from one trade zone to another.