In an effort to boost revenue collection, authorities, led by the State Fiscal Service, are aggressively ramping up their efforts. However, the field of state control itself is a sensitive area prone to corruption. It is where the business community interacts most with government institutions, thereby increasing the risks of corrupt practices.

The business community periodically reports cases where regulatory bodies excessively, disproportionately, and abusively intervene in business activities, often violating legislation or exploiting procedural provisions and criminal components. Such interventions are perceived by the business community as extortion or, in some cases, attempts to take over their businesses, as reported by BANI.md.

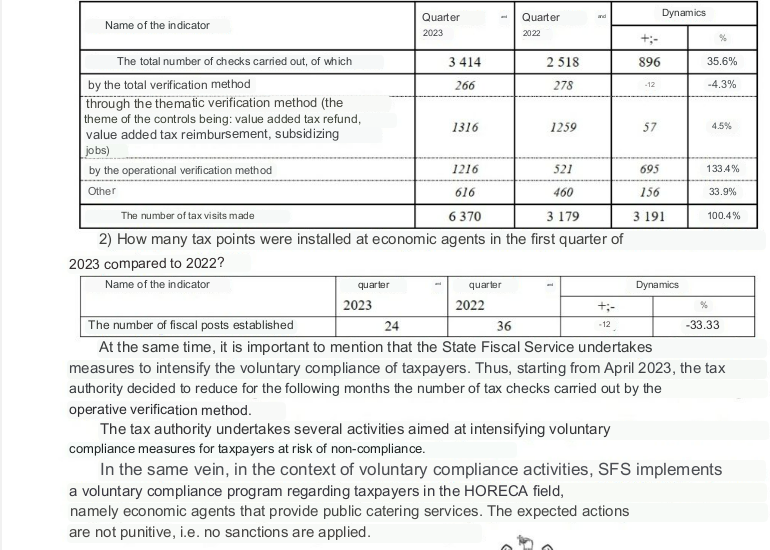

The State Fiscal Service has intensified its tax visits to entrepreneurs, conducting 6,370 inspections, which is 3,191 more than in the first quarter of the previous year, according to the institution’s response provided to BANI.md. The total number of tax inspections reached 3,411, an increase of 896. However, measuring the performance of regulatory bodies based solely on the number of inspections reveals that the ultimate objective of the state apparatus seems to be the cultivation of violations and revenue collection opportunities rather than achieving a higher number of law-abiding individuals.

Regarding inspection methods, there were 266 total verifications, 12 fewer than in the first quarter of 2022. Total verification refers to on-site fiscal control of all acts and operations related to determining taxable objects (bases) and settling tax obligations after the last fiscal inspection. It is both documentary and factual, examining how taxpayers comply with fiscal legislation.

FOR THE MOST IMPORTANT NEWS, SUBSCRIBE TO OUR TELEGRAM CHANNEL!

Through thematic verification methods (including value-added tax refund, value-added tax reimbursement, and job subsidies), 1,316 inspections were conducted, an increase of 57. Thematic verification, as stipulated by fiscal legislation, applies to both chamber and on-site fiscal control, focusing on specific tax obligations or compliance with other obligations prescribed by fiscal legislation. It involves examining documents or a taxpayer’s activities.

Operational verifications, carried out by tax inspectors, totaled 1,216, representing an increase of 695. Operational verification applies to on-site fiscal control, where economic and financial processes, related documents, and operations are observed to determine their authenticity and prevent violations of fiscal legislation. Operational verification is conducted unexpectedly, either factually or documentarily. If any violations are detected and further investigation is required, the materials are passed on to the respective subdivisions responsible for fiscal control to conduct a more in-depth examination using other technical methods.

In addition, the tax authorities reported 616 inspections under other types of verifications, compared to 460 in the first quarter of 2022. Furthermore, during the first three months of 2023, the State Fiscal Service installed 24 fiscal posts, 12 fewer than before.

In conclusion, the increased number of tax inspections gives the impression that control bodies have set minimum thresholds for the amounts to be collected through fines, in line with the current year’s budget forecasts and, in particular, the provisions of the State Budget Law, which already includes revenue from fines and penalties. This drives inspectors to constantly seek opportunities to impose fines, often resulting in a focus on finding violations regardless of their severity or significance.