Moldova held early parliamentary elections in July 2021. The old government, which identified as pro-Russian and deemed corrupt and old-fashioned by the media, was replaced with a new, pro-European and young government. While there might be some concern regarding the lack of experience of the newly elected officials, there is great hope that they will succeed in reforming the entire system.

What the new government already managed to do is sending a powerful message that corruption will not be tolerated anymore, as well as changing people in key functions. In turn, these actions managed to regain the trust of external partners of Moldova. Recently, the European Union announced numerous macro-economic packages offered in the form of grants and long-time loans, meant to further help the government implement reforms. Considering this direction, the authorities now expect the interest of the business people to invest in Moldova to only grow in the next period.

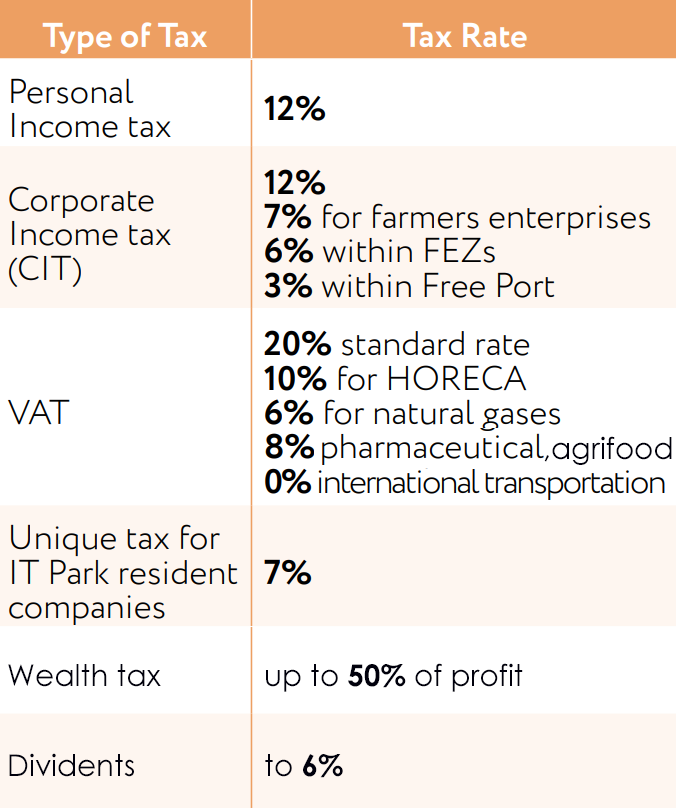

But what can a investor expect from the Moldovan Fiscal system? According to the official site Invest Moldova, the country’s fiscal system can be easily deemed as a friendly one.

By its nature, the fiscal system of the Republic of Moldova is progressive. There are two types of taxes: general state (central) taxes and duties, and local taxes and duties.

These are the main central payments:

- income tax is 12% for legal entities and 12% for individuals; however in the case of legal entities this tax may be lower if we consider a farmer- 7%, a resident of the Free Economic Zone – 6%, or a resident of the Giurgiulești International Port – 3%;

- value-added tax is different: the standard rate is 20%, but for HORECA it is 10%, for pharmaceuticals and agrifood it is 8%, for natural gases 6%, and for international transportation 0%;

- excises vary between 0.5% and 5%, depending on the tariff position of a given product;

- customs duty may be as high as 30%, although there are plenty of exemptions and preferences;

- road duty, which depends on the engine’s capacity or the vehicle’s weight;

- wealth tax, which includes the land and real estate payments – up to 50% of profit;

- dividends amount to 6%.

National and international projects

The authorities take additional measures to support domestic companies in various industries, demonstrating flexibility and responsiveness to taxpayers’ wishes:

– Duty exemptions for farmers who bear losses in connection with climate conditions.

– Incentives for investors engaging in industrial production in a Free Economic Zone or Industrial Park may serve as examples in this regard.

– More recently, the Moldovan Government has introduced a number of tax exceptions for businesses in order to compensate their losses over the COVID-19 pandemic.

– On the other hand, tax exemptions are common in the case of international projects or activities based on bilateral agreement between Moldova and the state that is the source of investment; as a result companies that move their operations to Moldova and create new jobs get even better conditions. The same is valid for public-private partnerships, national projects such as road building and strategic industries such as automotive or wine-making.

– A large number of tariff positions are advantaged in the case of imports (raw materials, for example) and exports (final products).

– In some cases investors have the option of direct negotiations with the authorities.

Eager to find more? You can visit this site.