In the past week, the Moldovan Leu experienced a slight depreciation against major currencies but continues to maintain its position as the strongest currency in Europe and beyond, according to Veaceslav Ionita.

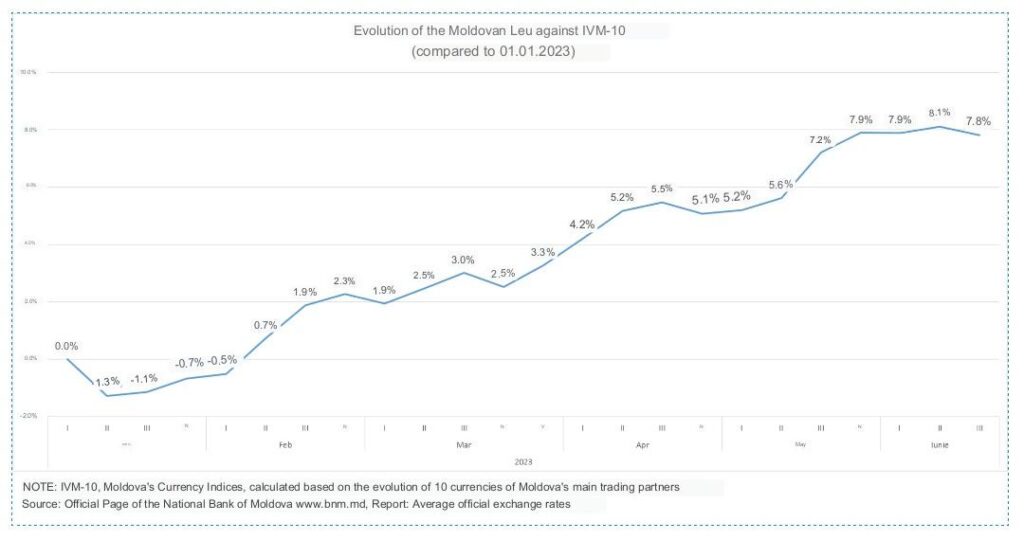

Even after a marginal depreciation of 0.3% recorded from June 12th to June 18th, 2023, the Leu is currently 7.8% stronger compared to the beginning of the year against the top 10 currencies of Moldova’s largest trading partners.

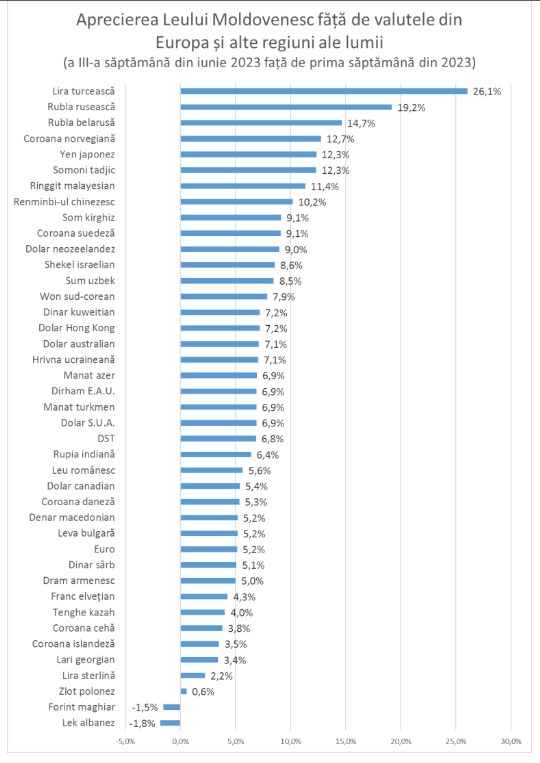

Furthermore, a comprehensive analysis of all reference currencies on the National Bank of Moldova’s website reveals that the Moldovan Leu has appreciated against all except two currencies—the Hungarian Forint and the Albanian Lek.

This appreciation can be attributed to two main factors: 1) a relatively significant decrease in currency demand from economic agents, and 2) a substantial increase in currency supply from individuals.

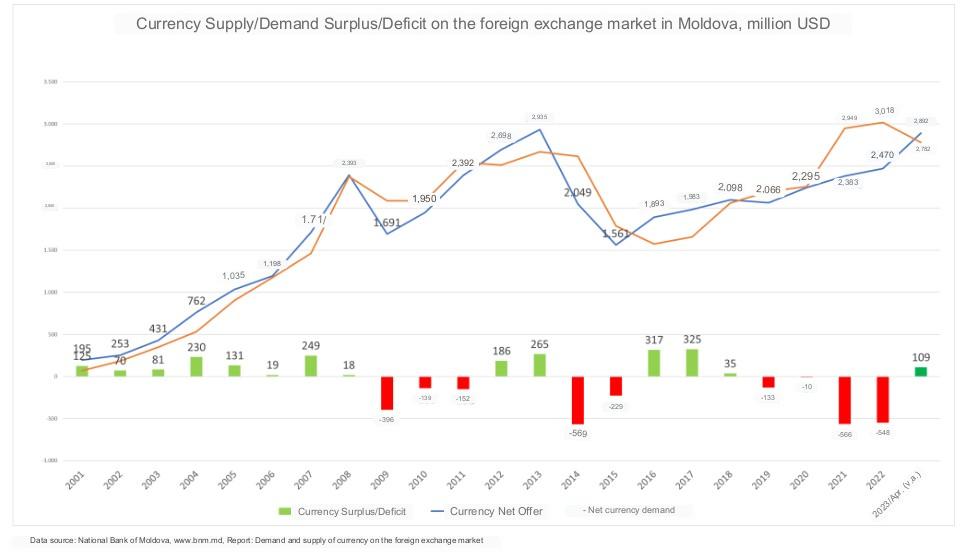

On an annual basis, currency demand from economic agents has decreased by $236 million, dropping from $3 billion in 2022 to $2.8 billion in April 2023. This decline is driven by both the decline in energy resource prices and stagnation in consumer spending. It is our belief that currency demand from economic agents will continue to experience a slight decline in the coming months.

FOR THE MOST IMPORTANT NEWS, SUBSCRIBE TO OUR TELEGRAM CHANNEL!

The currency supply from individuals has reached $2.9 billion, approaching the all-time record set in 2013. In my opinion, this increased supply is influenced by three factors: a) the population’s consumption needs that are not covered by current incomes. Prices have risen faster than incomes, prompting people to use their foreign currency savings for part of their consumption; b) the conversion of currency due to the ongoing conflict in Ukraine. In the first two months of the conflict, the Moldovan population acquired approximately $500 million in foreign currency, which is gradually being converted back into Moldovan Leu; c) the significant increase in pseudo-remittances. A considerable portion of the currency entering the country in favor of individuals is, in fact, the repatriation of currency by economic agents who sold goods to countries like Russia, with the real value of the transaction exceeding the official value. Consequently, foreign currency enters the country and goes directly into the foreign exchange market. This phenomenon still requires further analysis to provide more details. However, it is certain that the currency supply from individuals will continue to grow, and I believe that the annual value will soon surpass the $3 billion mark.

After four years of a foreign exchange deficit, there is currently an annual surplus of $109 million, which is expected to continue increasing in the coming months.

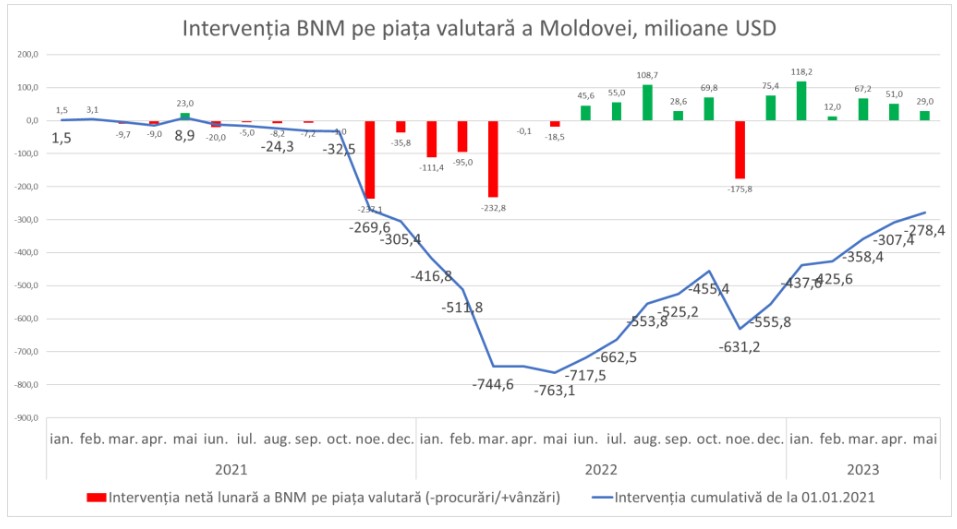

Consequently, to prevent further appreciation of the Moldovan Leu, the National Bank has been intervening by purchasing foreign currency throughout this period. From December 2022 to May 2023, the National Bank has acquired $353 million. With the onset of the energy crisis, the National Bank intervened by selling currency and made net sales of $763 million by May 2022. However, in just six months, it has repurchased two-thirds of the currency sold during the crisis period.

In the upcoming months, the foreign exchange market will exert pressure towards the appreciation of the Moldovan Leu, and only intervention by the National Bank will counter this appreciation trend.

It is worth mentioning that a strong Leu benefits the population as it results in lower prices for imported goods and lower inflation. However, a strong Leu significantly affects the domestic economy and reduces the competitiveness of local products.

Given the declining inflation, the National Bank of Moldova must ensure a slight depreciation of the Leu, which will support the local economy without adversely affecting the population.